Will a meatless food industry featuring lab-grown meat, seafood substitutes, and insect protein be the future of food? As Covid-19 upends the traditional meat supply chain, food giants and startups alike are working to navigate a future where protein isn’t dominated by conventional meat sources.

At the moment, meat is still king.

By some estimates, 30% of the calories consumed globally by humans come from meat products, including beef, chicken, and pork. The global meat market could be worth as much as $2.7T by 2040, according to CB Insights’ Industry Analyst Consensus.

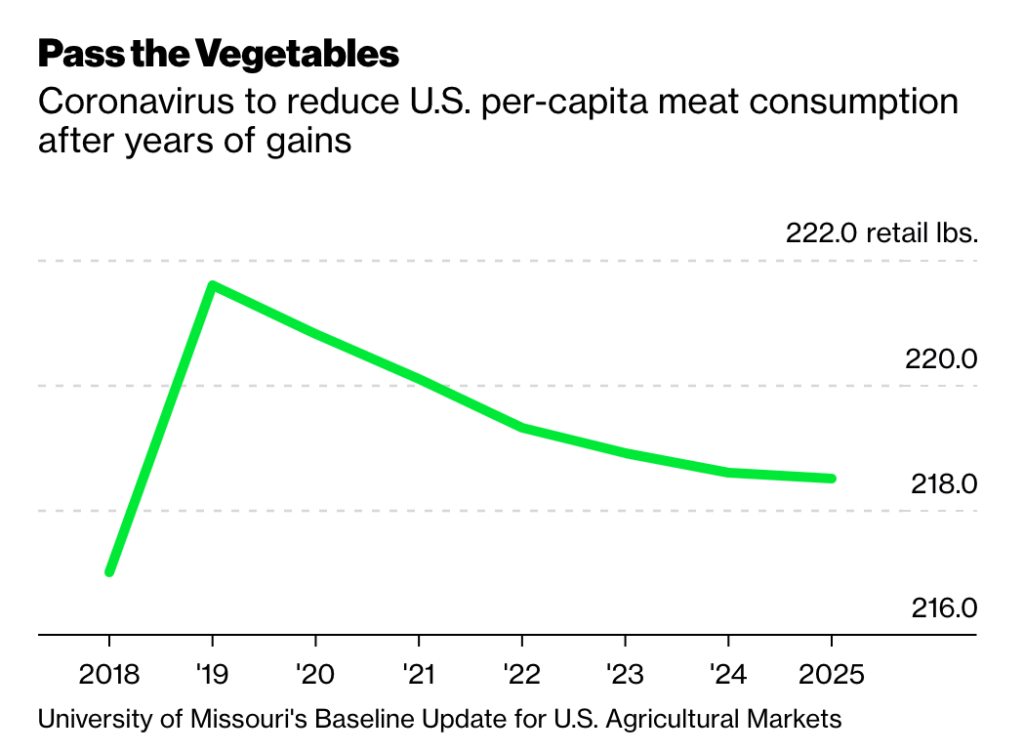

Americans consumed a record 225 pounds of red meat and poultry per capita in 2020 — in 1960, that figure was just 167 pounds, according to the USDA.

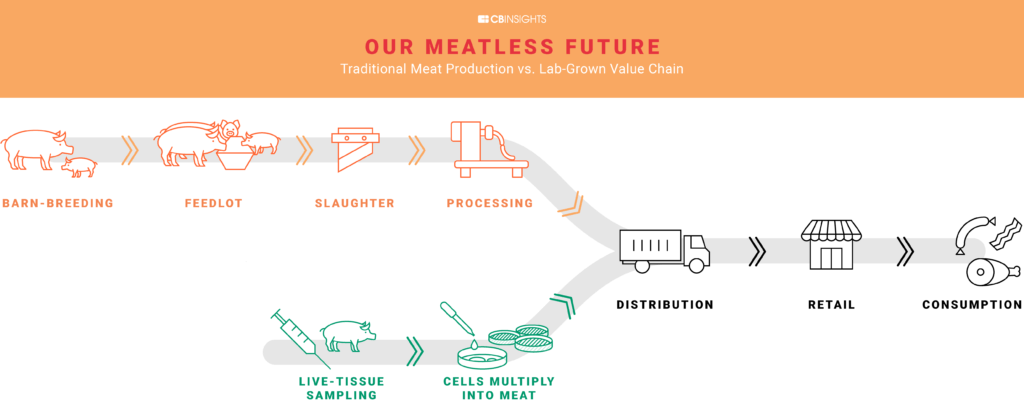

To meet this growing demand, the meat industry has evolved into a complex global business that involves farms and feedlots, as well as meat middlemen, like processing and storage centers, transportation and logistics, slaughterhouses, and more.

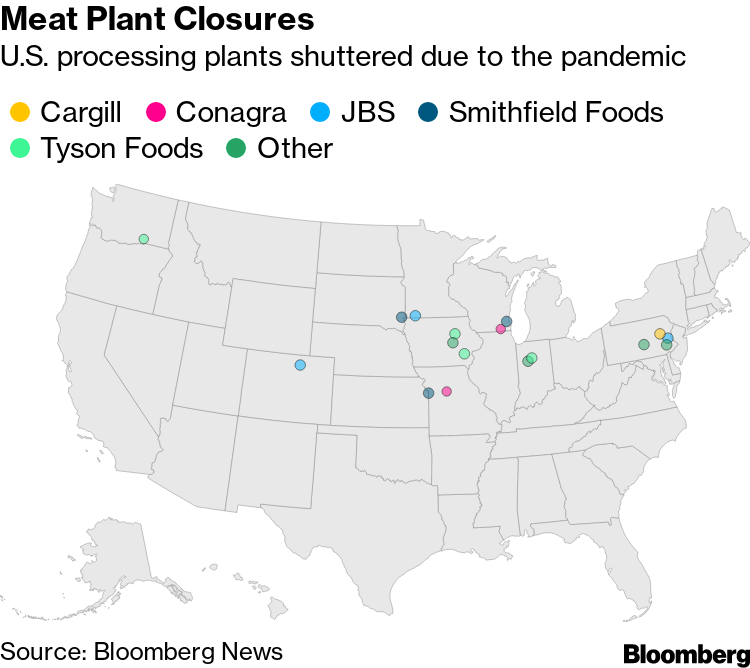

In the US, just 4 producers — Tyson Foods, JBS, Cargill, and National Beef — control more than two-thirds of all US beef processing.

But as Covid-19 has spread across the globe, shifting consumer behavior and virus outbreaks in factories has dealt major blows to the meat supply chain, with the beef industry alone facing an estimated $13.6B in losses.

Source: Bloomberg

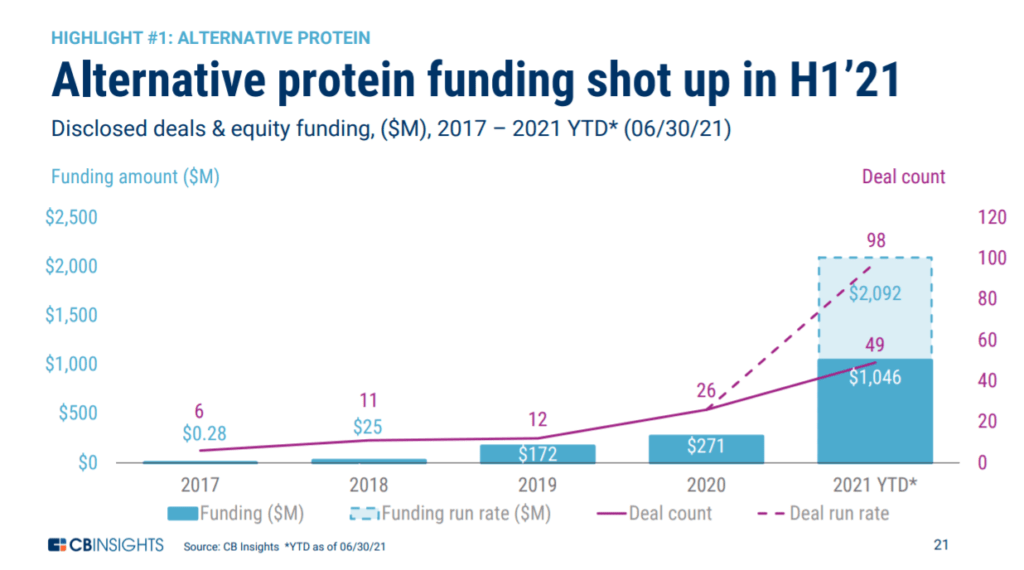

In contrast, startups focusing on plant-based protein — such as Plantible Foods, Rebellyous Foods, Livekindly, and InnovoPro — have continued securing millions in funding amid the pandemic. Demand for vegan meat has soared, with retail sales of plant-based meat alternatives reaching $7B in 2020 — an increase of 27% from 2019, according to one report.

Going forward, the meat value chain could be simplified dramatically, as “clean meat” labs could take the place of farms, feedlots, and slaughterhouses.

Using CB Insights data, we dig into some of the major trends in the growing meatless industry, from startups to watch to key investors to future trends & challenges.

The current state of the meat and plant-based industries

In the past decade, the meat industry has seen massive consolidation, as companies like Hormel and Brazil-based JBS have grown bigger and bigger through the acquisition of new meat brands and products.

One of the biggest deals in this space was pork producer WH Group’s $4.7B acquisition of US-based Smithfield Foods, which owns brands such as Armour and Farmland, in 2013.

Since 2014, Hormel has spent over $6.5B on acquisitions, including Applegate Farms, Fontanini Italian Meats and Sausages, Ceratti, and Sadler’s Smokehouse. Hormel also acquired the Planters brand of snacks for $3.35B in February 2021, further expanding the company’s footprint into the consumer snacking market.

Despite high-profile deals in the sector, the industrial meat industry faces a rising tide of challenges related to business, ethical, and environmental concerns.

These corporations have also begun the shift into plant-based protein amid pressure from upstarts and changes in consumer behavior. JBS, one of the world’s largest meat companies, launched its own meatless protein in June 2020 and acquired Dutch plant-based meat manufacturer Vivera, Europe’s third-largest plant-based foods producer, for $408M (€341M) in April 2021. Other meatpackers offering their own lines of plant-based alternatives include Tyson, Smithfield, Hormel, and Cargill.

Source: Vivera

Meanwhile, startups using technology to engineer meat in labs or manufacture it from plant-based products are rising in popularity.

In 2019, one of the world’s biggest alternative protein brands, Beyond Meat, which manufactures the plant-based Beyond Burger, went public at a valuation of almost $1.5B. The company reported net revenues of $407M in 2020, a year-over-year increase of almost 37%, and net losses of $53M, driven largely by the challenges posed by the Covid-19 pandemic.

Beyond Meat began offering direct-to-consumer (D2C) sales in August 2020 and announced partnerships with Yum! Brands and McDonald’s in 2021. It also intends to expand its manufacturing capabilities in the Chinese and European markets throughout this year.

In particular, the company is looking to make inroads in Asian markets, inking deals to offer its products at Starbucks and select KFC, Pizza Hut, and Taco Bell stores in China. Its Beyond Pork products are the first Beyond product developed specifically for the Chinese market.

Source: Beyond Meat

However, while Beyond products have proven popular with consumers, the company has also suffered some high-profile failures in certain markets. In the US, Dunkin’ discontinued sales of Beyond Sausage products at franchises nationwide in June 2021 due to disappointing sales, though select locations will still offer the product.

Beyond Meat’s chief competitor, Impossible Foods, has also seen aggressive growth. The Redwood City-based company has aggregated more than $1.5B in total disclosed funding. Its products can be found at chains like Burger King, Qdoba, White Castle, and Red Robin. Valued at $4B as of March 2020, Impossible Foods has seen rapid expansion, forging partnerships with Kroger, Starbucks, and Trader Joe’s.

Impossible Foods president Dennis Woodside has said he expected the company’s retail footprint to expand more than 50-fold in 2020 alone.

“This is why I think people are increasingly aware plant-based products are going to completely replace the animal-based products in the food world within the next 15 years,” Impossible Foods founder and CEO Pat Brown said in a June interview. “That’s our mission. That transformation is inevitable.”

Unlike Beyond, which has relied primarily on retail sales and smaller restaurant operators, Impossible’s decision to forge strategic partnerships with restaurant chains resulted in steady growth even during the height of the Covid-19 pandemic; many of Impossible’s restaurant partners are nationwide chains with Covid-friendly drive-through and delivery options, which has traditionally been a comparative weakness for Beyond.

Impossible Foods has also invested in efforts to reposition itself in the mind of consumers in an attempt to differentiate itself in an increasingly competitive market. The company embarked on a nationwide ad campaign to highlight the taste and texture of its products in April 2021, and the company appears keen to distance itself from the “plant-based” messaging typical of products in the space in an attempt to appeal to hesitant meat consumers who may be reluctant to try plant-based meat alternatives.

“We’re tapping into what you expect from a burger ad. The over-the-top burger, dripping with cheese. We talk about it as new meat in old meat’s clothing.” — Jessie Becker, Senior VP, Marketing, Impossible Foods

Although Beyond Meat still commands a significantly larger market share than Impossible Foods, Beyond’s lasting dominance is far from assured.

Why the shift toward meatless?

Covid-19 may accelerate the shift to meatless alternatives

During the onset of the coronavirus pandemic, the meat industry was slammed by warnings of meat shortages due to shuttered plants, resulting price increases, and growing numbers of sick workers — conditions that would potentially present new opportunities for plant-based companies.

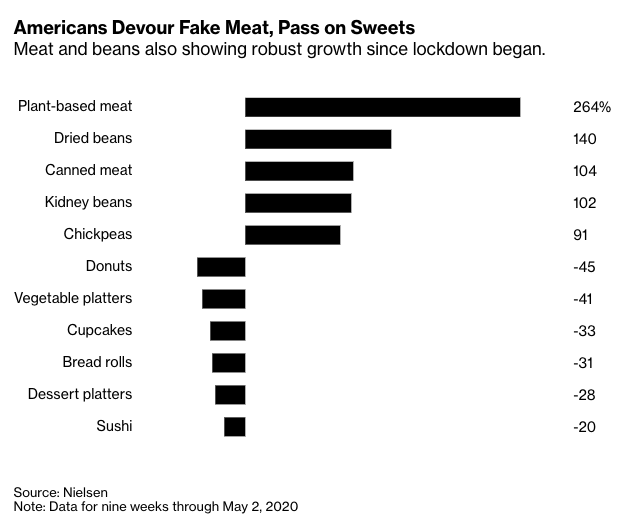

Traditional meat distribution channels were and remain upended, as restaurants, schools, and other facilities closed. Declining output and rising prices left consumers with fewer options, and plant-based meat alternatives began to see a lift.

Source: Bloomberg

The plant-based meat industry saw sales surge 264% in the 9 weeks ended May 2, 2020. While these numbers are still a small portion of meat sales, their growth highlights the opportunity that meat alternatives gained amid the pandemic.

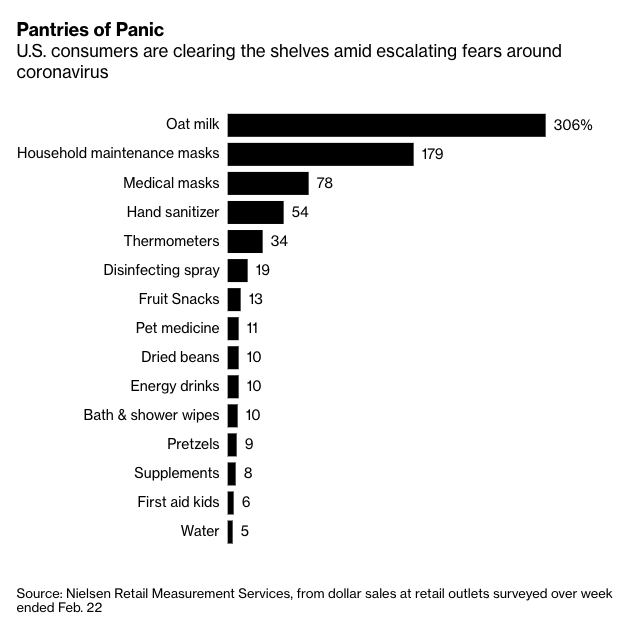

Even dairy alternatives saw a surge: in the first week of March 2020, oat milk sales were up 347% year-over-year against a backdrop of declining dairy demand. According to some estimates, sales of oat milk have increased by 1,200% over the past two years alone — growth that demonstrates how consumer appetites are shifting significantly.

Beyond the shortage, the pandemic has also forced many consumers to face issues in the meat supply chain for the first time, including the health of the workers or the ethical treatment of animals.

Reports of the millions of animals being euthanized as slaughterhouses were forced to close fueled consumer distaste. The outbreak resulted in reportedly the largest pig culling the US has ever seen, with about a billion pounds of meat destroyed in the second quarter of 2020 alone.

As America’s largest meat suppliers reopened, their employees reported unsafe working conditions, with scarce precautions for social distancing. Meatpacking plants were found to be coronavirus hotspots — nearly 54,000 meatpacking workers have tested positive for Covid-19 and at least 270 have died have died, according to the Food and Environment Reporting Network.

Some outbreaks, such as that of a Los Angeles pork production facility owned and operated by Smithfield Foods, have persisted for over a year, with reports of repeated health and safety violations contributing to an ongoing cycle of infection and disruption.

News of meat factories’ concentrated Covid-19 outbreaks may cast traditional meat products in an unappealing light, influencing consumers to opt for plant-based alternatives instead.

“Covid is shining a light for consumers to start evaluating their own choices and whether or not they want to continue to buy meat,” Josh Balk, vice president of farm animal protection for the Humane Society, said in an interview with Bloomberg News.

Source: Bloomberg

However, the pandemic has not been the sole operational challenge facing the country’s largest industrialized agribusinesses. Attacks on these companies’ computer systems have brought production to a halt, causing widespread delays and shortages. JBS’ computer network was compromised by malicious actors in May 2021 in a ransomware attack that resulted in the temporary closure of all JBS production facilities in the US. The incident also disrupted production in JBS’ Australia-based facilities.

Macro reasons propelling the meatless trend

Beyond Covid-19, there are several macro-level reasons for the shift toward a more meatless future.

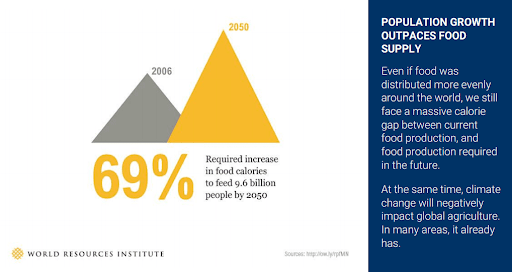

Forces like urbanization, population growth, and a rising global middle class lead to greater meat consumption. Approximately 56% of the world’s population lives in urban settlements, and this percentage is expected to increase to 68% by 2050, according to the UN.

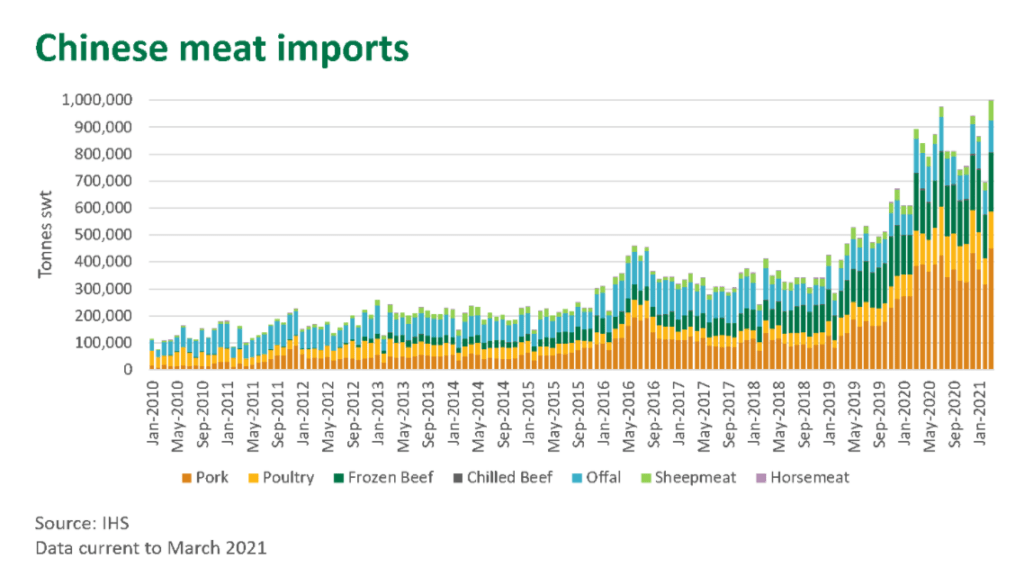

Meanwhile, the world’s population is expected to surge to 9.7B by 2050, leading to a massive increase in food production. Emerging markets are driving this growth: China, in particular, is the world’s largest consumer of meat, with protein consumption expected to grow by around 4% a year due to its rising middle class.

Data from the USDA estimated that China was on track to consume more than 40M metric tons of pork in 2020 — more than double the amount consumed across the entire European Union. While the Covid-19 pandemic had a disruptive impact on meat consumption across China, the country’s appetite for meat as a whole continues to increase, though plant-based meat alternatives are also gaining in popularity.

This increasing demand could create challenges for feeding future generations, and meatless companies are looking to help fill the gap.

Source: World Resources Institute

Alternative protein sources can reduce the negative environmental impact associated with meat production, as livestock is a major contributor to greenhouse gas emissions. Additionally, reducing livestock could free up global cropland, decrease soil erosion, and relieve pressure on the world’s water supply.

Consumers are also seeking healthier food alternatives. Rising obesity rates across the globe, coupled with consumer interest in healthier food alternatives, are also driving demand for meatless proteins.

In 2019, the annual retail food market grew by 2.2%, but plant-based foods swelled by 11.4% in comparison, according to the Plant Based Foods Association. The following year saw even stronger growth, with retail sales of more than $7B in 2020 — an increase of 27% that dwarfed the 15% growth observed across US retail food sales as a whole that year.

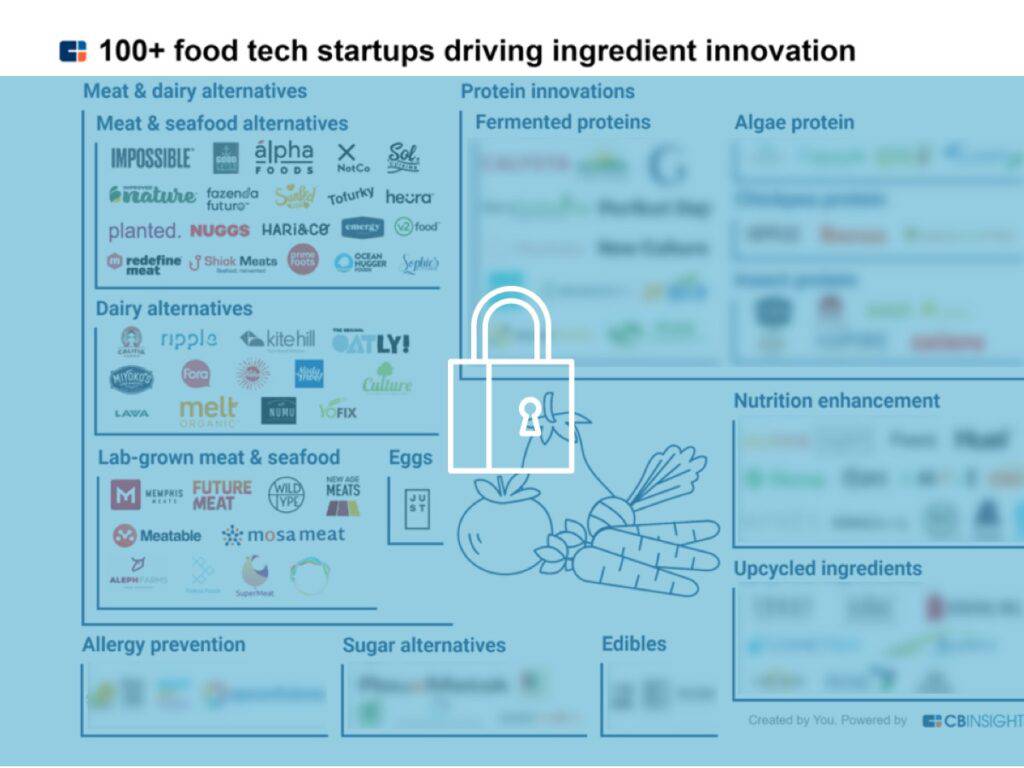

Additionally, advances in ag tech and synthetic biology are enabling high-tech meatless products. Cellular agriculture and molecular engineering are fueling tech-enabled meat substitutes that better emulate the flavor and texture of traditional animal meat. (We cover 100+ startups driving ingredient innovation in this client-only brief.)

Meatless consumption could also alleviate ethical questions around meat consumption, as the meat industry has long been subject to ethical concerns behind meat production practices.

Rising consumer desire for transparency around the food supply chain is giving traction to blockchain projects tackling meat and food traceability. For example, agriculture giant Cargill announced in 2017 that it was testing blockchain technology to show turkey buyers where their individual bird came from.

“Distributed ledger technology allows for transparency and traceability across the supply chain. One of the pilots we are running is for our Honeysuckle White Turkey, where a very simple distributed ledger collects data on the origination of the turkey, the story of that farm, who owns it, and its location, and brings that information all the way to the store, where it is available to the consumer.” — Justin Kershaw, CIO, Cargill

Meanwhile, the Norwegian Seafood Association partnered with IBM in June 2020 to leverage its blockchain to ensure food traceability in its supply chains, a network known as the Norwegian Seafood Trust.

Michael Jacobs, CEO of Norwegian Seafood Trust partner Atea Norway, hopes that this tracking technology becomes standard in the Norwegian salmon industry, one of the country’s largest economic sectors. Consumers in central Europe can already scan QR codes on salmon packaging to learn more about sustainable fishing initiatives and the journey their fish took to reach supermarket shelves.

Alternative meats could also reduce contamination: Growing lab-grown meat in a sterile environment can cut back on contamination and eliminate antibiotics from the meat production process. This could play a role in reducing global health problems linked to the current food production value chain.

Alternative protein startups are innovating across the meatless ecosystem

Given rising consumer interest and pandemic-caused meat plant shutdowns, more startups are innovating in the meatless space. They are not only competing with prepared and frozen meats, but also exploring other methods of incorporating non-meat proteins into diets, with snacks or meal substitutes.

MEAT & DAIRY ALTERNATIVES

MEAT & SEAFOOD

Plant-based burgers that ‘bleed’ and taste like the real thing

Plant-based burgers have seen a jump in popularity. Startups producing these burgers are targeting both meat-based and plant-based diets by 1) increasing options for vegetarians and vegans and 2) using a meat-like taste to help entice meat eaters to consume environmentally-friendly protein.

“We think of it as meat made a better way … Meat today basically is made using pre-historic technology, using animals to turn plants into this very special category of food … But to your typical consumer … the value proposition of meat has nothing to do with its coming from an animal.” – Pat Brown, CEO of Impossible Foods

Impossible Foods, one of the biggest players in this space, leverages molecular engineering to create “bleeding” plant-based burgers that the company claims are nearly indistinguishable from meat.

The company’s use of heme, an iron-rich molecule in animal proteins, has enabled it to replicate the “meaty” flavor in its plant-based products.

Impossible Foods last raised a $200M Series G in August 2020; its $500M Series F in March 2020 brought its valuation to $4B. To date, the company has raked in more than $1.5B in total disclosed funding.

Instead of directly targeting consumers, Impossible Foods started by targeting the commercial and restaurant market with its meatless burger product. In 2017, Impossible patties could only be found in around 40 US restaurants. By 2018, that figure had reportedly grown to more than 3,000. Today, Impossible products can be found in more than 20,000 restaurants across the US, Canada, Hong Kong, Macau, and Singapore.

In early 2019, Impossible Foods launched its largest restaurant partnership yet — the Burger King Impossible Whopper. Burger King also recently announced that it would add the Impossible Foods sausage to its menu.

In May 2020, Impossible Foods announced that its patties would be sold across 1,700 Kroger-owned grocery stores nationwide, a dramatic increase from just 150 grocery stores selling its burger at the beginning of 2020.

Impossible Foods also inked another major deal in June 2020, when Starbucks announced that it would add the Impossible Sausage sandwich to its US menu. The following month, Impossible announced that its products would be sold in Trader Joe’s grocery stores, as well as more than 2,100 Walmart locations, expanding Impossible’s retail presence significantly. At that time, retail sales of Impossible products had more than doubled monthly since April 2020. The company has increased its retail footprint by 50x since the start of the Covid-19 pandemic.

It has also introduced a few other types of meat products to accompany its main ground beef product, including meat-free sausage and a plant-based pork product.

Source: Impossible Foods

Beyond Meat is another major competitor in the space, making plant-based burgers and other imitation meat products such as plant-based chicken and sausage.

After receiving a total of $164M in disclosed equity funding, Beyond Meat went public in May 2019. Beyond Meat’s stock price surged after its IPO, with its market cap increasing more than 8x within a few months — its current market cap hovers around $8B.

Beyond Meat, which primarily sells directly to consumers in grocery stores, has launched its own major retailer partnership, working with Dunkin’ Donuts to roll out a plant-based sausage breakfast sandwich in 2019. Despite the sandwich’s popularity among consumers, the product was ultimately discontinued in June 2021 as a result of disappointing sales.

In February 2021, Beyond Meat announced a partnership with Yum! Brands to develop plant-based menu items for the restaurant operator’s KFC, Pizza Hut, and Taco Bell stores. The company has also secured an agreement with McDonald’s to supply its McPlant patty, which it began testing in select McDonald’s locations in Denmark and Sweden in February 2021.

Looking beyond the American market, the company also announced a partnership with Starbucks to roll out its products in its China locations in March 2020. Beyond Meat also already sells its products in Starbucks’ Canadian locations, but was dealt a blow when Starbucks chose to debut Impossible Foods’ products in its US stores instead.

The faux meat maker opened its first production facility in Shanghai in 2021, and it already sells its products in Taiwan, Singapore, and Hong Kong.

Source: Beyond Meat

Beyond introducing new plant-based meat alternatives to markets around the world, some companies are working on improving the texture, mouthfeel, and flavor profiles of such products to make them more appealing to consumers. Motif FoodWorks, a food technology startup based in Boston, is one such company.

Motif is working on several proprietary ingredients that promise to make plant-based meat alternatives even more convincing to consumers skeptical about moving away from animal products. The company is developing what it describes as a new kind of “muscle protein” using precision fermentation — the same technique used by Impossible Foods to give its beef alternatives their distinctive flavor profile — to improve the taste of plant-based meat alternatives.

Source: Motif FoodWorks

Motif, which raised $226M in Series B funding in June 2021, is also working to solve two of the most difficult challenges in synthetic meat and dairy alternatives: improving the melting and stretching properties of plant-based, nondairy cheese products, and the cultivation of healthier fats to give meat alternatives the distinctive “marbling” common to traditional animal meats.

Motif is not the first company to tackle the challenges of recreating the mouthfeel and texture of animal meats in plant-based products. Spain-based Novameat has been experimenting with 3D-printing technologies to approximate the complex fibrous texture of steak since 2018. Motif’s work may, however, prove to be a crucial breakthrough that could have a significant impact on the synthetic meat industry as a whole.

Fish-free seafood alternatives

In addition to land-based meat, companies are applying similar processes to create sustainable seafood alternatives.

This is due to the ever-increasing demand for the ocean’s resources. With 90% of global fish stocks overwhelmed and overfished due to rising global demand, startups are looking for ways to satiate consumers without fully depleting the earth’s fish supply.

Because of the increased pressure on the fishing industry, companies in the seafood-alternative space are seeing greater media attention and funding.

“Shrimp has one of the worst supply chains in the seafood industry,” – Dominique Barnes, New Wave Foods Co-Founder & CEO

Pennsylvania-based startup Good Catch Foods raised a $26M Series B extension in April 2021, in addition to undisclosed investments from celebrities like Woody Harrelson, Paris Hilton, and Lance Bass in May, bringing its funding total to at least $77M.

The company develops vegetarian tuna, crab cakes, and fish patties and sells its products in Whole Foods, FreshDirect, and Thrive Market stores. Its seafood look-alikes are made from lentils, chickpeas, fava beans, and other legumes.

There are a number of other startups in the space. Finless Foods, which has raised almost $7M, uses cellular agriculture to grow fish meat, while New Wave Foods, which has received backing from Tyson Ventures, produces pea protein and algae-based imitation shrimp. Wild Type is a startup developing lab-grown salmon. It raised a $12.5M Series A in October 2019 to bring its total funding to $16M.

Additionally, French startup Odontella, which produces algae-based salmon, raised a seed round in October 2017. Its first product, a vegan smoked salmon from the Odontella aurita microalgae, was launched in April 2018. In mid-2019, the company announced that its next product would be a microalgae-based steak substitute named Tona. However, as of July 2021, the company had not yet released its Tona product, and development of commercial algae-based food products remains significantly overshadowed by plant-based proteins and lab-grown meats.

While still in the early stages of R&D, fish-free seafood products are further expanding the possibilities of an animal-free future. As with animal-free meat, fishless seafood could radically simplify and clean up the associated production value chains.

LAB-GROWN PRODUCTS

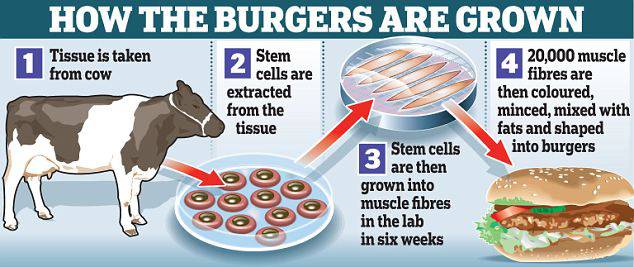

Lab-grown or “cultured meat” is another alternative meat product, but unlike some other offerings in the space, this approach is not plant-based imitation meat — it’s real.

Upside Foods (which rebranded from Memphis Meats in May 2021) produces meat from self-reproducing cells, thereby growing meat that is an “animal-based” product but avoiding the need to breed, raise, and slaughter huge numbers of animals.

The company debuted its first synthetic meatball in 2016 and followed up with the world’s first cell-cultured chicken and duck in 2017. Since its rebrand, Upside Foods has focused the majority of its R&D efforts on its synthetic chicken product due to chicken’s popularity among consumers and its versatility in a wide range of cuisines and dishes.

The company claims that its end-to-end Bay Area development facility “will produce, package and ship cultured meat at a larger scale than any other company in the industry, all under one roof.”

Source: Upside Foods

Upside Foods aims to decrease the cost of lab-grown meat in order to compete with commercial meat.

While its original meat cost $18,000 a pound, by January 2018, the company had gotten costs down to $2,400 per pound. The company also claims that it can produce animal-free products using just 1% of the land and 1% of the water compared to meat-producer incumbents. In March 2018, the company announced its intention to bring clean chicken and duck to stores by 2021.

Upside Foods raised 2 tranches of Series B funding totaling $186M in 2020, bringing its total funding to about $211M. Additionally, Tyson Ventures backed the company for an undisclosed amount in early 2018.

More recently, in a series of patents, the company announced its intention to use the gene-editing technique CRISPR in order to help it develop its lab-grown meat products with even less impact on the environment and even less consumption of land and water.

In the future, lab-grown meat companies like Upside Foods could cut production, slaughter, and processing out of the meat production value chain.

Upside Foods wasn’t the first company to explore lab-grown meat products: Dr. Mark Post, a Netherlands-based researcher, produced the world’s first lab-grown burger in 2013, in research originally financed by Google’s co-founder Sergey Brin. This initiative spun off into Mosa Meat, which aims to bring in vitro meat to market in the future.

Mosa Meat completed its $85M Series B round in February 2021, which the company plans to use to expand its production facilities in the Netherlands and bring its synthesized beef products to a broader range of consumers.

Another company in this space, New Age Meats, has raised nearly $3M for its lab-grown sausage product. The company raised $2M as part of an extension to its seed round in February 2021, which it intends to use to hire key personnel, such as bioengineers and product specialists, to bring its synthetic pork products to market.

Source: Mosa Meat

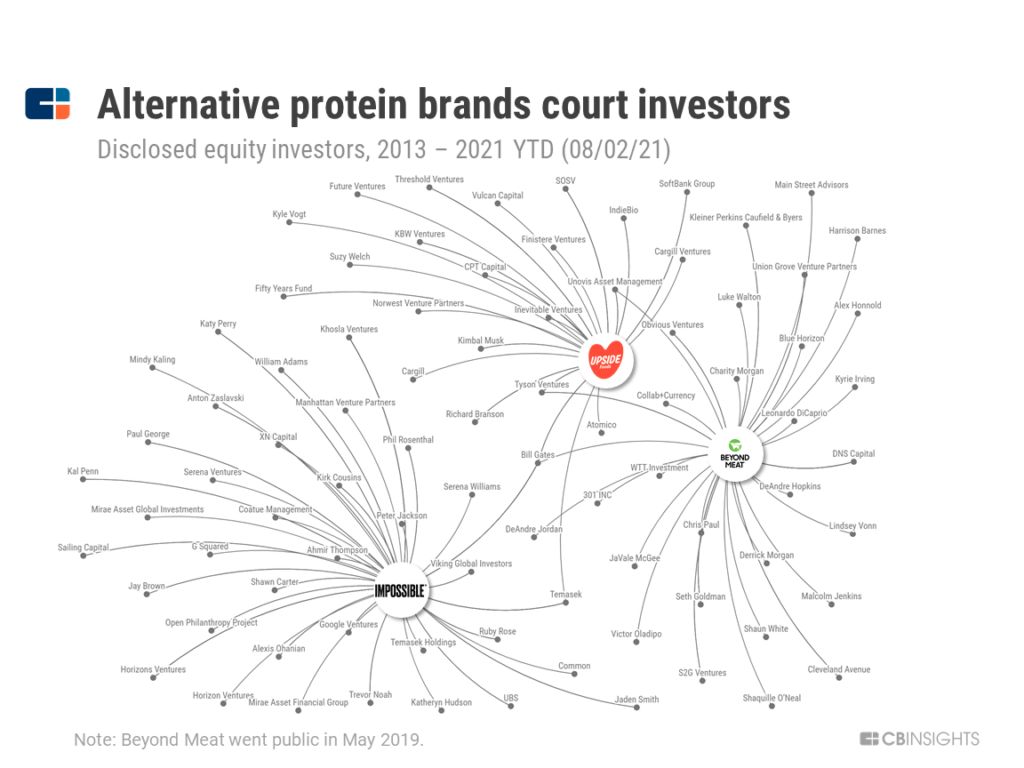

Both plant-based meat products and lab-grown “clean” meat have seen notable investors, including some top VCs (Khosla Ventures, Kleiner Perkins Caufield & Byers), meat corporates (Tyson Foods, Cargill), and others.

The regulatory future of lab-grown meat, however, is still uncertain. The USDA regulates meat production and advocates for agriculture, but the potential conflict of interest surrounding lab-grown meat has left both the FDA and USDA in charge of oversight of alternatively grown meat.

Furthermore, while the environmental benefits of lab-grown meat are potentially dramatic, meatless products are still significantly more expensive on a per-pound basis than animal alternatives.

Despite the significant commercial potential of lab-grown meats, innovation in the space has been hampered by the limited availability of cell lines, biological materials common in research laboratories that are vital for the research and development of synthetic proteins.

Scientists working in other fields can request cell lines from the American Type Culture Collection (ATCC), a bioresource repository in Virginia that has almost 4,000 unique cell lines from 150 species. For synthetic meat researchers, however, no equivalent of the ATCC exists. Thus far, many of the cell lines necessary to research lab-grown proteins are held by a handful of private companies, and availability of suitable cell lines is extremely limited. This means higher barriers to entry for new startups hoping to enter the synthetic protein space and a slower pace of scientific advancement in the field as a whole.

“There’s basically nowhere to start yet. If anyone wants to get into this field, it takes a significant amount of resources and time to acquire and characterize a cell line in-house.” — Elliot Swartz, Good Food Institute

The Good Food Institute (GFI), a nonprofit organization based in Boston that advocates for greater adoption of plant-based and other meat alternatives, is working to make cell lines more readily available for synthetic meat researchers. Unfortunately, progress to date has been slow and remains one of the biggest challenges new entrants into the space will have to overcome.

Methane-based protein sees early funding

Biotech companies are even exploring methods for engineering meat-like products from methane. While companies producing biotech foods are already creating methane-based animal feed, startups are now expressing interest in engineering methane-based protein fit for human consumption.

California-based Calysta last raised $45M in 2019, bringing its total disclosed funding to $138M. The startup manufactures its alternative protein product, which can replace traditional animal feed, by fermenting natural gas. It formed a joint venture with the China-based feed additive manufacturer Bluestar Adisseo in February 2020.

The two companies broke ground on a new plant in China in January 2021. Calysta claims the facility is the first commercial-scale single-cell protein production facility in the world. The plant is expected to go online in 2022 and will serve the Asian aquafeed market, which accounts for approximately 70% of the global aquaculture market. The facility will produce Calysta’s FeedKind sustainable protein, which researchers claim is an ideal feed ingredient for Japanese yellowtail, one of the most popular food fish in Japan and a common ingredient in sushi.

India-based String Bio, another startup in the space, has raised funding from Future Food Asia, Ankur Capital, and others to commercialize its technology, which leverages methane to develop alternative proteins for animal feed. The process works similarly to that of using barley as a source of carbon for the yeast used in the fermentation process in commercial brewing. String Bio’s technology uses methane as a source of carbon for the company’s proprietary bacteria, a process that results in protein “cakes” that are then refined into protein powders that can be used in the production of meat alternatives.

“We’d sell it [protein] to someone else who makes it into a steak-like product, or a fish-like product, or something like a tofu perhaps, that we could grill and eat…” – Ezhil Subbian, Founder & CEO at String Bio

While protein products developed by these companies are not currently fit for human consumption, methane-based proteins could help reduce the environmental impact of meat production, and eventually further fuel the meatless revolution by creating another food source.

In line with String Bio CEO Ezhil Subbian’s comment, the first step is creating a methane-based protein that can be marketed to humans and subsequently integrated into their diets.

Open-source clean meat startups take an alternative route

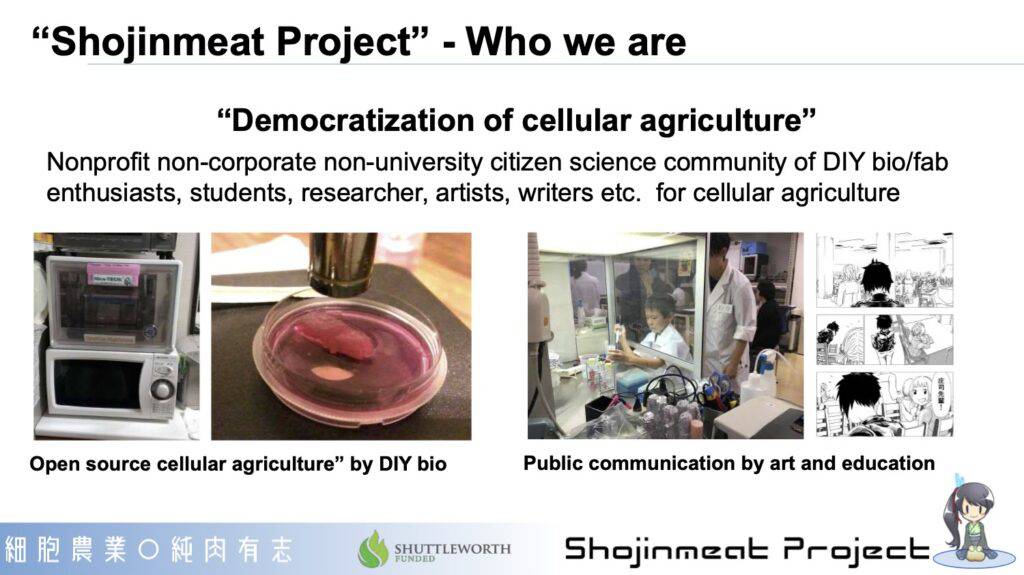

Some companies in the meatless space are competing to be first-to-market with animal-free products. Taking a different approach, Yuki Hanyu, founder of Tokyo-based IntegriCulture and nonprofit Shojinmeat Project, is working to acclimate future generations to a meatless future through open-source tech.

Hanyu is providing Japanese high school students access to specially designed heated boxes that allow them to culture animal cells at home and grow them into meat-like products.

The concept may seem far-flung, but the Shojinmeat Project is looking to establish a crowd-sourced, bottom-up approach to meat development that allows people to play with lab-grown meat and ultimately integrate it into their diets.

One of the primary motivations behind the Shojinmeat Project, which takes its name from the Buddhist principle of “shojin,” or the pursuit of enlightenment, is to make cellular agriculture less intimidating to the general public. Hanyu hopes that cellular agriculture will eventually become “just another form of cooking or a children’s summer science project” and that exposure to the process of cultivating synthetic meats will make such products more palatable to consumers.

Source: IntegriCulture

In August 2020, IntegriCulture was awarded a $2.2M grant by the New Energy and Industrial Technology Development Organization, a branch of Japan’s Ministry of Economy, Trade and Industry, to construct its first dedicated cellular agricultural production facility. Beyond the search for sustainable, cost-effective protein alternatives, the company’s cell cultivation technologies also show promise in the development of bioreagents used in medical research, nutritional supplements, and even cosmetics.

In February 2020, bioresearch platform Kerafast teamed up with nonprofit Good Food Institute to launch an open-source catalog with “recipes” for sustainable, lab-grown meat and seafood.

DAIRY & EGGS

Oat milk flew off the shelves in the early days of the pandemic, propelling Oatly to its IPO at a $10B valuation in May 2021. But the plant milk craze began long before 2020, as consumers increasingly lean toward plant-based diets and protein alternatives.

Source: Bloomberg

Americans are consuming 40% less milk than they did in 1975, according to the USDA, and data from the Economic Research Service suggests that the rate of decline in milk consumption has accelerated significantly from 2010 onward. Dairy alternatives have siphoned greater and greater market share from traditional dairy companies in recent years, squeezing traditional milk companies and even forcing some to begin production of alternative dairy products.

The pressure has forced 2 major industry players to restructure. Dairy icon Dean Foods declared bankruptcy in late 2019 and saw most of its assets snapped up by the Dairy Farmers of America in April 2020. Borden Dairy followed soon after, filing for bankruptcy in January 2020, and was quickly acquired by KKR and a private equity firm in July.

Several startups have capitalized on this trend, raising massive tranches of funding to address surging demand.

Pea-protein milk producer Ripple Foods, for example, recently saw a $56M Series D from Google Ventures, Inventages Venture Capital, and Prelude Ventures in June 2020, bringing its total disclosed funding to $176M.

In July 2021, AI-powered NotCo, which produces plant-based milks, eggless mayo, and other products, raked in $235M in Series D funding from Tiger Global Management and other investors at a unicorn-minting valuation of $1.5B. Its pea-protein based NotMilk product is sold in 3,000 stores across the US.

Another company, Perfect Day, uses fermentation to make cow-free milk. The company raised a second tranche of funding, boosting its Series C to $300M total in July 2020.

Meanwhile, plant-based startup Eat Just, which started off producing vegan mayo, has expanded to vegan eggs. Its products were initially sold in select Whole Foods, Fairway, and Walmart locations and have since become commonplace in many major supermarkets. In February 2018, Eat Just also announced a partnership with food provider Sodexo to serve its vegan egg product on campuses and corporate sites. By the end of September 2020, Eat Just’s products were available in approximately 17,000 retail stores in the US due to strong consumer demand.

As of March 2021, the company says it has sold the equivalent of 100M chicken eggs.

While Eat Just may be known for its egg alternatives, the company is also making moves into other synthetic proteins, including meat alternatives.

Eat Just’s GOOD Meat range has been in development since 2016, and the Singaporean government approved Eat Just’s cell-cultured chicken for commercial sale in December 2020 — the first approval of its kind. Singapore-based restaurant 1880 was the first establishment to begin offering Eat Just’s chicken substitute that month, which the company claims is the first restaurant in the world to sell dishes prepared using cultured meats.

Protein innovations

Beyond meat and dairy substitutes, some startups are developing sustainable food solutions by leveraging alternative protein sources such as algae or insects.

ALGAE FARMS GAIN TRACTION FOR THEIR SUSTAINABILITY

Algae serves as a source of sustainable, nutritious protein that grows rapidly, which has helped it garner some attention in recent years. Algae farms also avoid the problem of immense land and water usage that most farms face when growing traditional crops or raising livestock.

While a relatively niche market, companies like Algama Foods and Odontella are capitalizing on algae to make various food and beverage products, such as egg-free mayonnaise or salmon.

Source: Algama Foods

CHICKPEA PROTEIN GROWS POPULAR AMONG HEALTH-CONSCIOUS CONSUMERS

As consumers clamor for healthier and allergen-free alternatives, chickpeas are a popular source of protein for companies developing vegan food products.

One of the primary reasons that chickpeas are becoming an increasingly prevalent ingredient in protein alternatives is their natural protein content — just half a cup of cooked chickpeas contains the equivalent of 15% of the average daily recommended value — as well as their naturally low levels of saturated fats and high fiber content. Unlike some beans, which offer comparable nutritional value, chickpeas lack the “earthy” texture common in many beans, making them an increasingly popular source of protein among consumers.

Many plant-based meat brands already use peas to add protein to their products. Banza, which raised a $20M Series B round in November 2019, makes chickpea-based pasta, while Hippeas sells chickpea-based snacks like puffs and chips. Hippeas raised $50M in funding in January 2021 from The Craftory, an investment firm that supports socially and environmentally conscious companies.

Source: Hippeas

In October 2020, Israel-based chickpea protein company InnovoPro completed its $18M Series B round. It opened its first US-based subsidiary in December 2020, largely in response to strong consumer interest in chickpea-based products and the growing appetite for protein alternatives in general. The company’s proprietary chickpea protein alternative is currently used in products available in 10 countries, including Simply Free beverages in the US and Zero Egg, an Israel-based startup that develops egg alternatives.

While consumer demand for chickpea-based products is intensifying in many regions around the world, the European market has seen exceptional growth. European imports of chickpeas increased by 55% between 2015 and 2019, and domestic chickpea production has increased significantly; Bulgaria, Italy, and Spain now account for 90% of the domestic chickpea production market in Europe.

However, despite their increasing popularity, producers of chickpeas are wary of the market’s apparent volatility. The Indian chickpea production sector, the largest in the world, saw a spike in prices in 2016 due to intensifying demand, only to be followed by a major crash in 2018 due to overproduction. Prior to the emergence of the Covid-19 pandemic in early 2020, the global chickpea market — estimated to be worth approximately $16B — had settled into a period of comparative stability, but many producers remain concerned about market volatility, especially in the wake of the lasting production and supply chain problems caused by the pandemic.

INSECT PROTEIN GOES MAINSTREAM

While the idea of eating insects is taboo in some countries, bugs and insects are nonetheless growing as a nutritious, environmentally-friendly protein source.

2B people around the world eat insects, according to the UN’s Food and Agriculture Organization, and more than 1,000 species of insects and bugs are eaten in 80% of nations around the world.

To make insect consumption more palatable, startups are using insects as alternative ingredients, e.g. making flour from crickets, mealworms, and other insects, which can be raised at scale, or using them to produce snacks, protein bars, and even insect-enriched pasta.

Source: Reuters

Some notable startups in the space include Israel-based Hargol, which makes protein powder out of grasshoppers, and Canada-based Entomo Farms, which raises insects for human consumption. Entomo Farms currently has approximately 60,000 square feet of production space, which it uses to produce both its cricket powders and whole roasted insects. The company raised nearly $3M in January 2021.

Israel-based Flying Spark uses fruit fly larvae to produce protein powders, while Exo produces cricket-based protein bars. It raised $5M before being acquired by Aspire Food Group, an edible insect company operating in both Ghana and the US, in March 2018.

Chapul, an early player in the protein bar space, exited in the summer of 2019, citing difficulties convincing Western consumers to purchase cricket-based products. The company is pursuing the insect farming business instead.

Cricket-raising results in 100x lower greenhouse gas emissions than beef cow production, and crickets also have higher proportions of protein than beef or chicken. Moreover, because crickets require proportionally less feed than livestock animals, production is more efficient.

The Oklahoma-based startup All Things Bugs, founded in 2011, is seeking to develop a finely milled cricket powder that can be supplemented as a base ingredient in recipes. All Thing Bugs has supplied other insect-based food companies that are working in the cricket product space, including the aforementioned Exo and Chapul.

Insect-based protein brands could eventually displace meat-based snacks by offering healthier and more sustainable options.

The biggest challenge by far, however, is overcoming consumer hesitation. While insects are an excellent source of protein and fatty acids, which help reduce cholesterol, many consumers still do not perceive these products as viable replacements for traditional sources of protein. Recent surveys indicate that approximately 36% of consumers find the idea of eating insects palatable, and while this still represents a significant potential market, it may be some time before insect-based food products become truly mainstream.

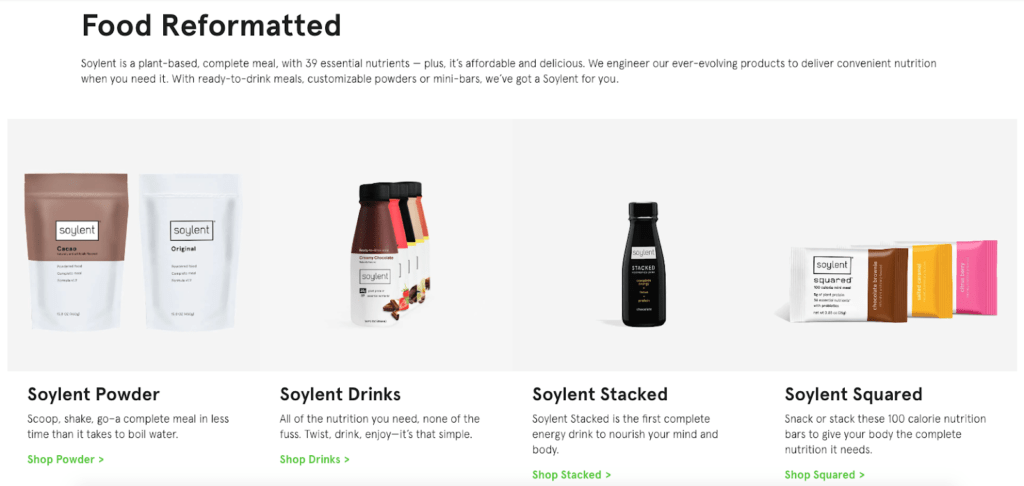

Meal substitutes

It’s not just meat substitutes disrupting the traditional food chain: meal replacement alternatives have gained some momentum in the food space, though the hype has diminished since its peak.

Among these startups, Soylent leads the pack with over $71M in disclosed funding from investors like Andreessen Horowitz, Lerer Hippeau Ventures, Google Ventures, and others.

The drink has run into some problems, including a now-lifted ban in Canada, where regulators said it does not meet all of their specific requirements for meal-replacement products. The company has also experienced a management shake up and downsizing — the CFO replaced the CEO in February 2020, and it also quietly shut down its Food Innovation Lab while downsizing to a smaller office.

Soylent has expanded distribution steadily, however. It focuses mostly on a D2C model, but is also available in retailers like 7-Eleven, Walmart, Target, and Kroger across the US, and launched in the UK in late 2018. Soylent has since made greater moves into the retail space with an expansion into Walgreens pharmacies and Rite Aid in 2021. The company is currently looking to attract more customers by positioning itself as a nutrition company.

Source: Soylent

The UK-based Huel, which raised $26M from Highland Europe, launched its product in 2015 and offers a flavored meal replacement shake similar to Soylent’s drinks. It also launched a snack bar in December 2019. The company says it was profitable for the first 3 years of its life, and though it made a loss in 2019, it expected to be profitable in 2020. Huel saw a surge in interest amid pandemic lockdowns and has expanded distribution to retailers like Sainsbury’s.

San Francisco-based startup Ample Foods raised $2M in seed funding in 2018 and 2 angel rounds over 2019 and 2020, bringing its total disclosed funding total to over $3.4M. Ample has taken aim at the plant-based food industry by offering meal replacement products, including a vegan option and one intended for ketogenic diets.

French powder-based meal replacement startup Feed raised $17M in 2018, bringing its total funding to over $21M, with the goal of propelling its meal-replacement products forward in Europe, with plans for future expansion to other regions.

The company offers French-made, vegan, gluten-free, lactose-free, and GMO-free meal-replacement options.

Corporates and accelerators back the meatless future

Corporates bet on new protein sources

Major corporations involved in the meat industry are investing in meat innovation, with some of the largest companies even rolling out their own meatless products.

In early 2020, JBS USA’s subsidiary, Planterra Foods, launched Ozo, a plant-based protein brand that offers burgers, meatballs, and ground meat. Tyson sells both plant-based alternatives, such as meatless chicken nuggets and plant-based shellfish, as well as blended, part-meat, part-plant options.

Smithfield also manufactures a line of soy-based protein, and Hormel is selling meatless ground meat. Food-trading giant Cargill, which previously invested in Upside Foods, announced in early 2020 that it would roll out faux meat patties made of pea and soy protein.

Source: Ozo

It’s not just the meat giants, either. Major food conglomerates are also jumping on the opportunity to invest in the plant-based trend, either by rolling out new product lines or investing in plant-based companies.

Nestle, which has introduced a veggie burger, said in May 2020 that it planned to infuse $100M into building a plant-based food facility in China. The facility, located in Tianjin, is now fully operational, and Nestle subsequently debuted its Harvest Gourmet brand at an event in Beijing in December 2020. Like other companies with a strong presence in the Chinese market, Nestle hopes its pork replacements will prove popular with Chinese consumers.

General Mills’ venture capital arm, 301 Inc, has infused cash into several plant-based food brands, such as Gathered Foods, Kite Hill, No Cow, and Beyond Meat. In late 2019, Kellogg’s launched a soy-based meat brand, Incogmeato, which offers burgers and sausages.

Kellogg’s launched a promotion to coincide with Labor Day in 2020, in which the brand challenged consumers to try its Incogmeato product as part of their holiday cookouts and celebrations. Numerous Instagram influencers participated in the campaign, and Kellogg’s gave away Incogmeato products to consumers who engaged with the brand on social media.

Kellogg’s plant-based meat alternatives have proven popular with consumers. The company reported a year-over-year sales increase of 4% in Q1’21, driven largely by its frozen foods division, including $400M in retail sales of its plant-based Morningstar brand.

Large grocery chains have also begun selling plant-based meat products, and more retailers, including Kroger, Wegmans, and Loblaw, have launched private label plant-based offerings.

Some have set their sights beyond the US, with PepsiCo snapping up Chinese snack company Be & Cheery, which offers plant-based sausage, in February 2020.

“Plant-based protein is growing almost, at this point, a little faster than animal-based, so I think the migration may continue in that direction.” – Tom Hayes, CEO, Tyson Foods

Additionally, the rise of corporate-backed funds with a strong emphasis on alternative meat production and innovation, such as Tyson Ventures, indicates that meat producers foresee the possibility of a meatless future.

Tyson Ventures has made multiple investments in Beyond Meat, but the venture arm sold its stake before the plant-based protein company went public. Tyson has since invested in other similar companies, like Upside Foods, the Israel-based Future Meat Technologies, MycoTechnology, and New Wave Foods. With the launch of this “Internet of Food” fund, Tyson appears to be looking to pivot from a meat producer to a broader protein brand.

Tyson expanded its Raised & Rooted plant-based brand in June 2021 with the launch of its new Plant-Based Bites product, which joins Tyson’s other plant-based frozen foods lineup. And, like many other companies competing in the space, Tyson also has ambitious plans to expand into the Asia-Pacific market. Tyson’s First Pride brand, which launched in June 2021, will initially be limited to the Malaysian market before expanding to other countries across the region.

VC bets point to a meatless-minded future

Beyond corporates, venture capital firms and accelerators are also funding research and development into these high-tech foods. Biotech accelerator IndieBio has placed many bets in animal-free foods, with notable investments in Upside Foods, New Wave Foods, and Finless Foods, as well as startups focusing on dairy and gelatin substitutes.

See more alternative protein investment trends in our State Of Food Tech Q2’21 report.

Early-stage venture capital fund New Crop Capital funds startups that develop cultured and plant-based meat, dairy, and egg products, along with service companies that facilitate the promotion and sale of these products.

New Crop Capital’s investments include participating in a $10M investment for plant-based seafood company Good Catch (which is run by the founder of New Crop Capital), multiple seed rounds for packaged plant-based foods company Alpha Foods, and participation in lab-cultured meat startup Upside Foods’ $17M Series A.

Big Idea Ventures is a hybrid venture firm that also offers an accelerator program, with a focus on plant-based food/alternative protein startups. It closed a $50M fund in May 2019 to invest in plant-based foods, and most recently closed a $6.5M fund in June 2020. It’s backed by Tyson Foods, Temasek, the Singaporean government’s venture arm, and plant equipment manufacturer Bühler Group.

However, while plant-based foods and protein alternatives are of great interest to venture firms, there is hesitation among some investors about the long-term sustainability of some businesses and the competitive landscape of the space in the coming years.

Even concepts with solid proprietary technologies and strong commercial potential, such as algae-based food products, have struggled to gain the kind of traction that brands including Beyond Meat and Impossible Foods have experienced. With barriers to entry high enough already — especially in the cultured meats space — it may be difficult for new companies to compete with now-established brands seeking to expand into new markets.

The meatless revolution is global

The greatest concentration of alternative meat deals has occurred in the US, which is home to a well-developed food and beverage sector. At the same time, there are also developed and fast-growing meatless markets in Europe and Asia.

As Covid-19 has an increasingly negative impact on the meat industry, Chinese consumers are also opting for animal-free alternatives — and US-based companies are looking to break into the market. Sales of Eat Just’s egg product on JD.com and Tmall have reportedly jumped 30% since the outbreak, while companies like Impossible Foods and Beyond Meat are working to launch their products in mainland stores.

But competition is fierce, with local companies like Whole Perfect Food, Jinzi Ham Company, and Zhenmeat also looking to dominate the market.

In September 2017, China announced a $300M deal to import lab-grown meat from 3 Israel-based companies — SuperMeat, Future Meat Technologies, and Meat the Future — as part of a broader plan to decrease the country’s meat consumption by 50%.

Source: MLA

Regulation is also starting to play a bigger role, as regulators explore cellular agriculture as a viable food source in the future and individual US states, particularly in meat-producing regions, respond to the economic forces represented by meatless trends.

In March 2017, the National Academies of Sciences, Engineering, and Medicine in Washington, DC released a report on the future of biotechnology developments and regulation, while the White House launched a review of how US agencies regulate agricultural biotechnology.

Legislation seeking to prevent plant-based meat products from being labeled as “meat” or “beef” is now being developed in around half the states in the US, with successful bills passing in several prolific meat-producing states.

In March 2019, the FDA and USDA announced a framework to regulate cell-based meat, outlining a transparent path to market for cell-based meat companies.

As of now, artificial meat regulation is still in the early stages. Regulatory responsibility in an animal-free ecosystem could extend across multiple bodies, as biotechnology for food overlaps with many regulatory systems. Alternatively, a single regulatory agency could be created in the future to deal with the unique challenges of artificial meat regulation.

Challenges

While plant-based products and other protein sources are taking off, lab-grown meat, in particular, faces a few obstacles.

First, fake meat often sounds icky. Many consumers face a psychological barrier toward eating lab-grown foods and may prefer the familiar taste of traditional meat products.

While groups like the aforementioned Shojinmeat Project are looking to acclimate future consumers to cultured meat, this socialization will need to happen on a global scale.

Source: Shojinmeat

Second, high-tech meat is expensive. Cost remains a largely prohibitive factor, with high-tech meat alternatives priced as luxury goods.

One of the main reasons that lab-grown meat is so expensive is due to fetal bovine serum, or FBS, being prevalent in these products. FBS, which is extracted from cow fetuses, is a core and costly ingredient in lab-grown meat. As noted above, bovine cell lines remain notoriously difficult to source, even for larger companies with greater resources than new entrants. Given the popularity of synthetic meats among consumers and the strong commercial potential of such products, incumbents have little reason to share the biological materials underlying their innovation with potential competitors.

However, startups are looking to eliminate FBS from the meatless equation in order to cut costs. Eat Just has reported that it has developed a method to grow cell-cultured chicken without FBS, while Upside Foods is validating methods to produce its meats without the ingredient.

Third, the question remains: can clean meat scale? Though many startups in the space claim that their products will revolutionize meat consumption, the question remains whether clean meat will provide a scalable method to feed the future — or whether it’s simply a new wave of molecular gastronomy.

The aforementioned cost considerations are crucial in scaling these products for mainstream consumption.

Furthermore, will meatless products really be better for the environment? Despite claims that less meat consumption will reduce environmental impact, lab-based technologies come with their own high costs for electricity, heating, and other resources.

The automation of meat production could have far-reaching job implications for the agriculture industry. The meat sector is the largest employer within US agriculture, and mainstream meatless consumption could create economic challenges that eliminate jobs across the meat production value chain.

Meat producers, lobbyists, and other bodies have a great deal at risk when considering the effects of automation across the meat industry.

Where the meatless revolution is headed next

The race is on.

Cost and scale are immediate considerations in moving these products from novelty purchases to kitchen staples.

This issue is particularly urgent when attached to the $1.6T annual bill in economic costs that meat consumption could rack up globally by 2050, according to a University of Oxford study.

In the next few years, we can likely expect to see the cost of lab-grown meat decrease considerably.

From there, it’s just a matter of which companies will get their products to market first and best position their products as worth the price.

Continued advances in genetic engineering and plant-based innovation will enhance the taste, flavor, and healthiness of meatless products to incentivize consumption.

These technologies will also continue to expand across largely untouched meat and seafood categories (e.g., pork, duck, and eel). We could see direct competitors to meat incumbent brands across virtually all frozen and prepared food categories.

Amid Covid-19-induced shortages and the heightened consumer focus on ethical consumption, alternative meat products are seeing soaring interest, capturing investor and public attention alike.

This report was created with data from CB Insights’ emerging technology insights platform, which offers clarity into emerging tech and new business strategies through tools like:

- Earnings Transcripts Search Engine & Analytics to get an information edge on competitors’ and incumbents’ strategies

- Patent Analytics to see where innovation is happening next

- Company Mosaic Scores to evaluate startup health, based on our National Science Foundation-backed algorithm

- Business Relationships to quickly see a company’s competitors, partners, and more

- Market Sizing Tools to visualize market growth and spot the next big opportunity

Original Article by: This report was created with data from CB Insights’ emerging technology insights platform, which offers clarity into emerging tech and new business strategies, CB Insights